Shareholder Returns

Basic policy

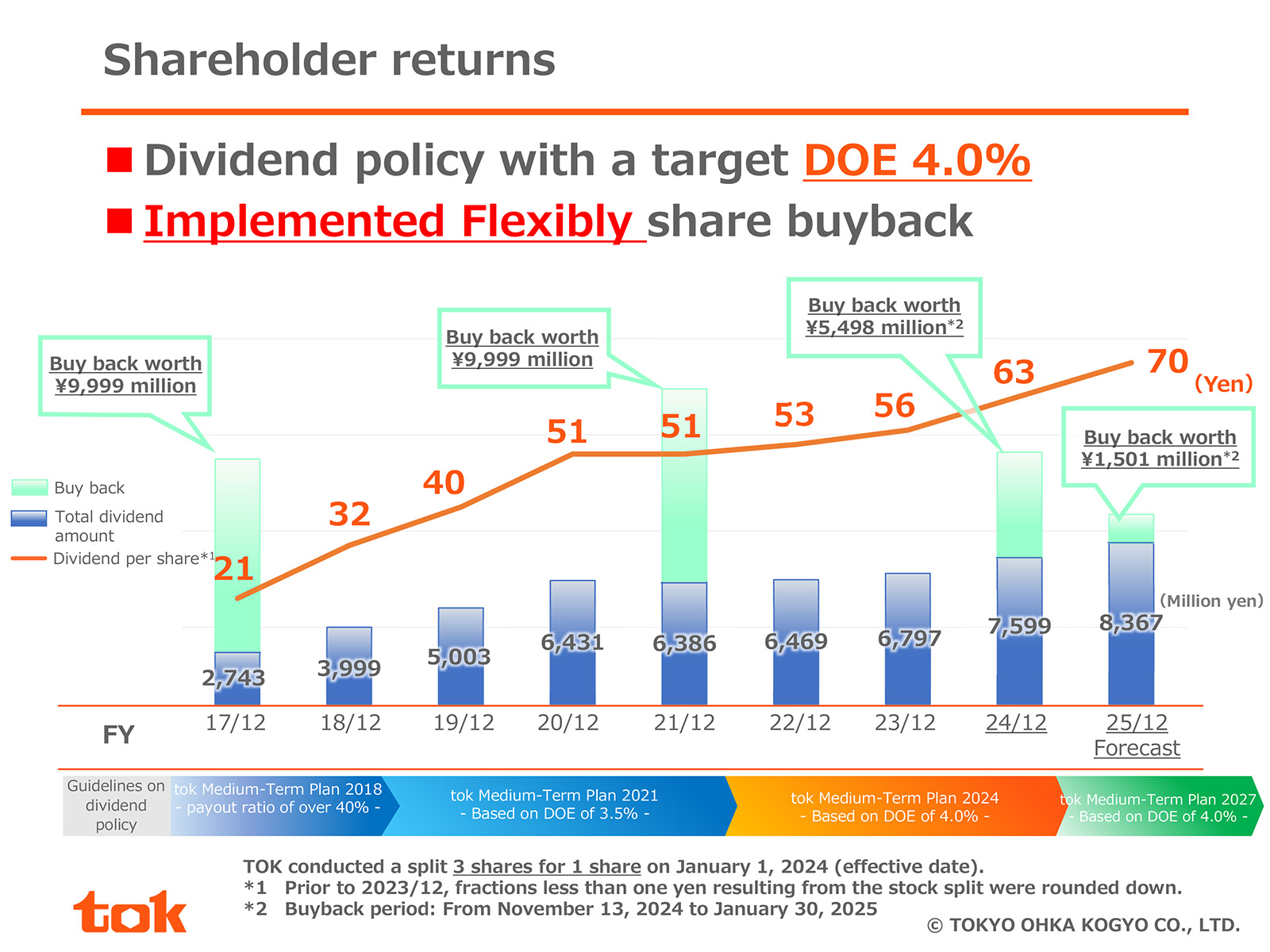

- Aiming for a consolidated dividend on equity (DOE) ratio of 4.0%.

- Flexibly conduct share buyback.

The company regards the return of profits to shareholders as a key management issue to be addressed.

While considering matters from a long-term perspective and upon comprehensively taking into account our financial position and performance, we will strive to secure internal reserves to fortify our competitiveness and increase our earnings.

In order to return profits to shareholders on a stable and ongoing basis, we set shareholder return policy to determine dividends with a target of DOE (consolidated dividend on equity ratio) 4.0% and to flexibly carry out share buy-backs as a way to return profits to shareholders.

Internal reserves should be used effectively as the underlying funds for efforts to achieve the sustainable enhancement of corporate value, including through proactive R&D investments in new technologies and products that will give rise to new growth, investments

in production facilities to improve quality and further streamline existing business operations, and the reinforcement of business expansion in Japan and overseas.

Changes in Shareholder Returns and Dividends

|

Fiscal Year |

Fiscal Year Ended Dec. 31, 2017 |

Fiscal Year Ended Dec. 31, 2018 |

Fiscal Year Ended Dec. 31, 2019 |

Fiscal Year Ended Dec. 31, 2020 |

Fiscal Year Ended Dec. 31, 2021 |

Fiscal Year Ended Dec. 31, 2022 |

Fiscal Year Ended Dec. 31, 2023 |

Fiscal Year Ended Dec. 31, 2024 |

Fiscal Year Ended Dec. 31, 2025*2 (Forecasts) |

|---|---|---|---|---|---|---|---|---|---|

| Total dividend | 64 | 96 | 120 | 154 | 156 | 160 | 168 | 63 | 70 |

| Interim dividend | 32 | 36 | 60 | 60 | 62 | 78 | 82 | 29 | 35 |

| Year-end dividend | 32 | 60 | 60 | 94*1 | 94 | 82 |

86 |

34 | 35 |

| DOE (%) | 1.9 | 2.8 | 3.5 | 4.3 | 4.1 | 4.0 | 3.8 | 4.0 | ー |

| Payout ratio (%) | 46.3 | 58.2 | 92.3 | 64.3 | 36.2 | 32.7 | 53.3 | 33.5 | 34 |

| Buy-back (Millions of Yen) | 9,999 | ー | ー | ー | 9,999 | ー | ー | 5,498 | 1,501 |

|

Guidelines on dividend policy |

tok Medium-Term Plan 2018 - Consolidated payout ratio of over 40% - |

tok Medium-Term Plan 2021 - Based on consolidated DOE of 3.5% - |

tok Medium-Term Plan 2024 - Based on consolidated DOE of 4.0% - |

tok Medium-Term Plan 2027 - Based on consolidated DOE of 4.0% - | |||||

*1 Including commemorative dividend of 30 yen.

*2 The company conducted a 3-for-1 stock split of common stock on January 1.